Buybacks - financial engineering to drive returns

This is a short bonus article about the power of share buybacks on earnings per share.

Companies really can eat themselves. If a company spits off free cash flow it may decide to buy back its own shares in the open market. This reduces the number of shares in issue, and thus increases the earnings per share for remaining shareholders. Increasing earnings per share puts fuel under the share price. So buybacks can be an accelerator towards multibagging.

Warren Buffett thinks that cash generative companies should often not pay out dividends. He’d rather they buy back their own shares in the market. One of the reasons for this is that dividends get taxed at an income tax rate for regular shareholders (if not held in a tax efficient holding vehicle like an ISA), whereas buybacks actually mean you can bypass that tax effect.

Apple and buybacks

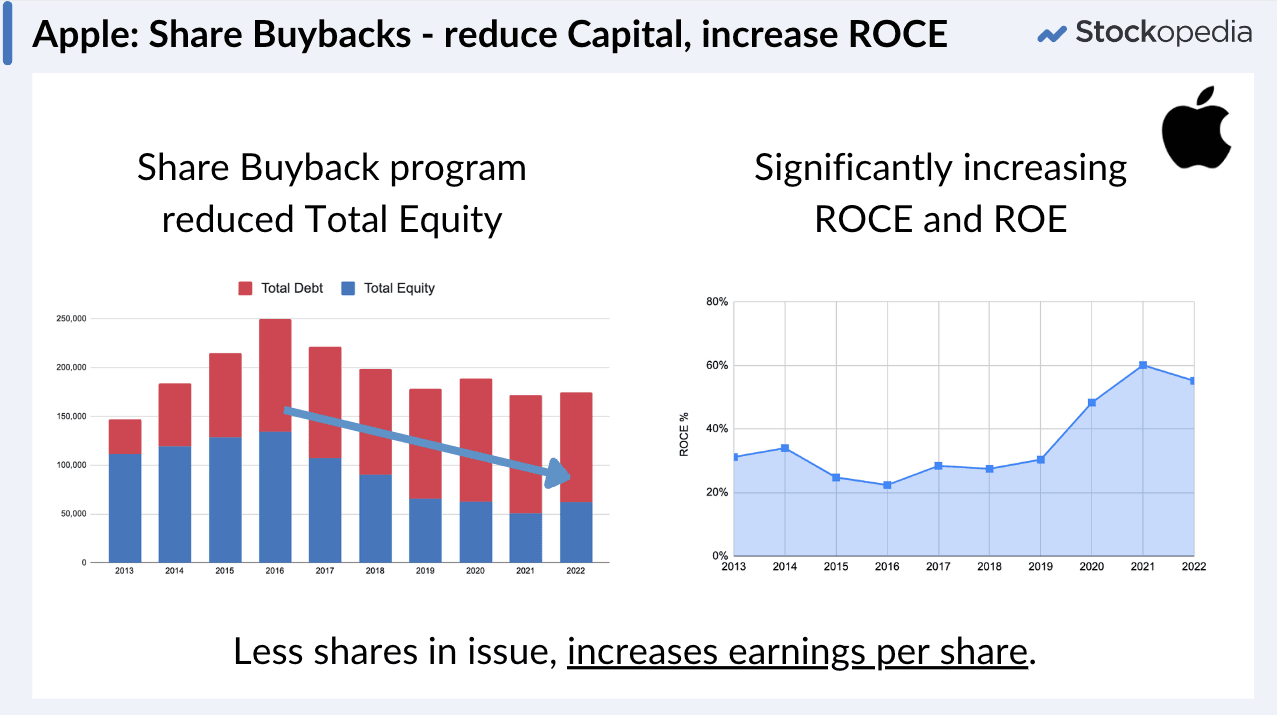

Apple has used share buybacks quite aggressively to reduce the total equity on its balance sheet. In the chart below, you can see in blue the total equity which grew as the business retained a lot of profit, but it initiated a very significant share buyback program in 2016, which reduced the total equity forwards through time. That reduction in equity is due to the company going out in the open market and buying back shares at a reasonable price. Because the denominator is smaller in the Return on Capital calculation, it will actually significantly increase the Return on Capital too.

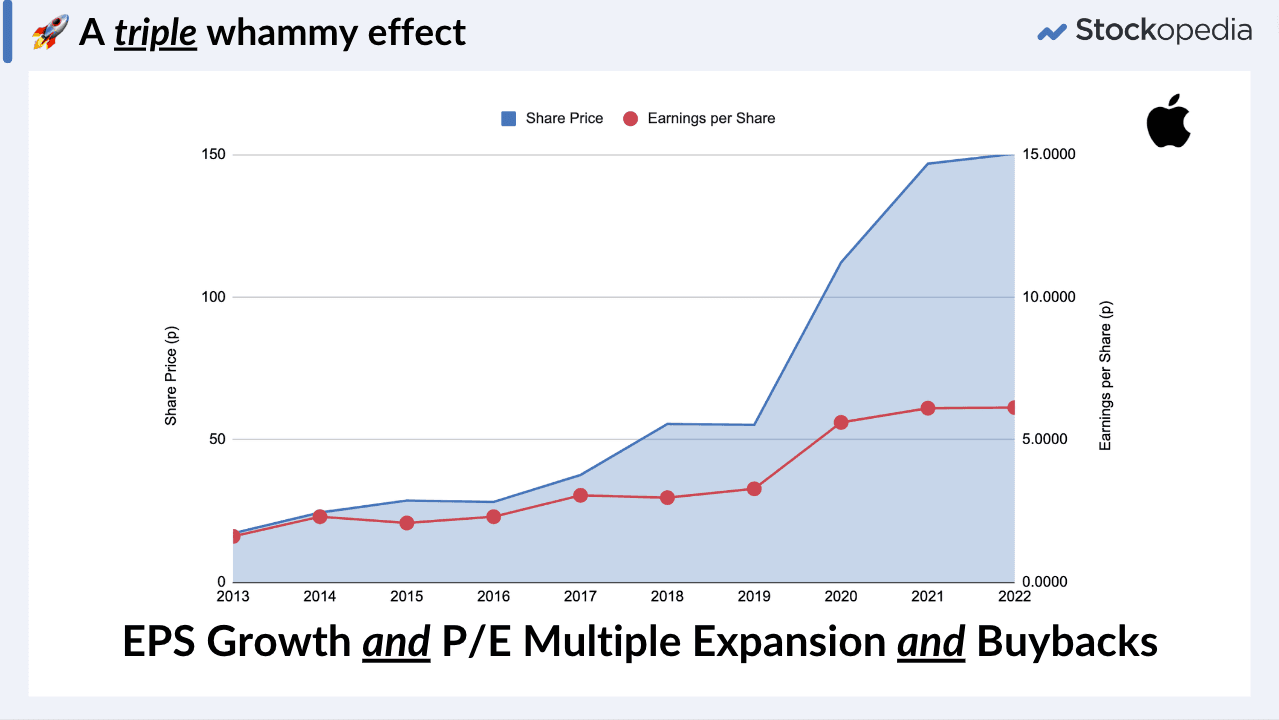

Less shares in issue increases earnings per share, and that's really good for you as a shareholder. In some ways, you could say that there was a “triple whammy” effect going on at Apple as there was earnings per share growth, as well as P/E multiple expansion, but not accelerated by buybacks.

So I just wanted to leave you with that insight. Several of the multibaggers, we witnessed in the top ten multibaggers have already started to buy back their own shares. Buybacks are often a sign of maturity - as businesses mature, they may start doing buybacks. Look out for it as a positive sign.