What investment styles are you truly exposed to?

We have written before about the importance of carefully selecting your strategy when you first set up your portfolio.

Our tools and content at Stockopedia can help with this. For example, we have the Strategy Map series which can help you identify the correct investment strategy to fit with your timeframe and mindset.

We also have our proprietary StockRanks, which offer an easy solution to gaining exposure to the factors which drive market return. You can find out more about these core factors in this guide and understand how our StockRanks make it easy to use factors in your own investing by clicking here.

Which styles are you exposed to?

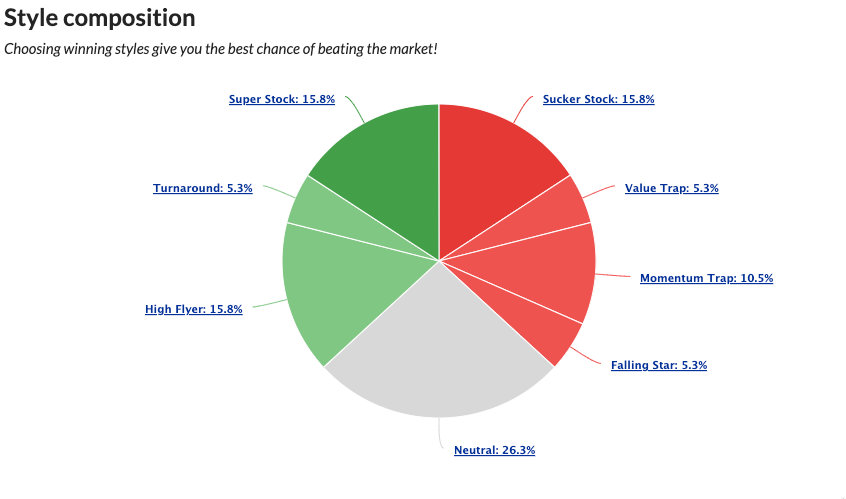

The Style composition chart within the Allocation tab of your Folio can help you assess which styles your portfolio is currently exposed to.

It is worth checking your current allocation to help diagnose what might be driving your portfolio's returns. Perhaps you are overexposed to Sucker Stocks which may be killing your portfolio. You can find out which styles can help set you on your way to healthy returns in this guide.

Checking your portfolio allocation and making sure it matches your desired strategy and rules is important.

Maintaining the focus

Even if you do nothing with a portfolio, its initial weights will slide out of balance over time as valuations change. The idea with rebalancing is that it cuts the risk of being overexposed to a small number of large positions, where an unexpected disaster could be seriously damaging.

Yet rebalancing is one of those subjects that rankles with some investors. That’s because, conventionally, it means trimming back successful holdings and feeding funds into lagging stocks. This kind of trading is counter-intuitive to many investors because it racks up trading fees, spread costs and potentially even taxes. Plus it doesn’t sit well with the idea of running winners and selling losers. All these reasons are enough to send rebalancing to the bottom of the list of priorities.

Indeed, rebalancing not only has disadvantages, but it’s arguably unnecessary for some types of investors. For example, active traders build and weight portfolios based on detailed analysis and conviction. In some ways, this kind of constant adjustment dispenses with the need for periodic rebalancing.

But for more passive investors, rebalancing can be a very important part of the strategy - especially those that aim to harvest the powerful market factor premiums mentioned above. For those who run portfolios based on these kinds of investment styles, there is a constant risk of style drift without rebalancing.

What this means in practice is that value stocks that rise in price will eventually cease to offer the value premium any more. The same goes for momentum, which can persist for extended periods, but will eventually fade. With the portfolio no longer exposed to those kinds of factors, it's obvious that rebalancing is important.

You can use the charts in the Folios tool alongside our guide to winning and losing investment styles to help ensure your own portfolio maintains high exposure to the stocks that are more likely to generate better investment returns.